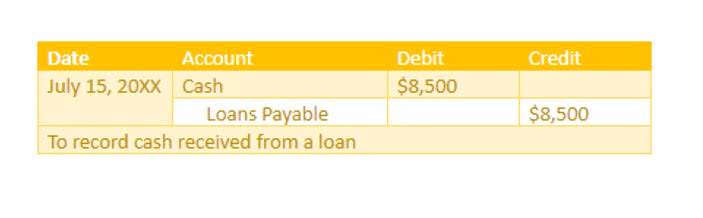

Most crypto companies already accept BTC, ETH and other cryptos as payment. In a double-entry accounting system, you record a debit and a credit of the same amount at the same time. In a triple-entry accounting system, a debit, credit, and a third entry is recorded.

When it comes to Bitcoin bookkeeping, the blockchain is your best friend. The blockchain is a public ledger that records all Bitcoin transactions. By accessing the blockchain, you can verify and trace each transaction you make, ensuring that your records are accurate. If you’re unsure how to handle your Bitcoin bookkeeping for tax purposes or find it overwhelming, don’t hesitate to seek professional assistance. Professional help can ensure accurate reporting, minimize errors, and help you navigate the complexities of cryptocurrency taxation.

What are common crypto reporting issues with current accounting standards?

Bitcoin bookkeeping is essential for anyone who owns or transacts with this popular cryptocurrency. With the rising popularity and value of Bitcoin, proper accounting and bookkeeping practices are crucial to ensure accurate financial records. Crypto accounting software provides intelligent transaction classification based on the crypto data source’s labeling and categorization standards such as exchanges, trades, and withdrawals. It differentiates asset classes and simplifies crypto wallet accounting where transactions can have multiple outputs and for smart contracts accounting that can have multiple inputs and outputs. It identifies transactions occurring when exchange purchases are moved to wallets you own, ensuring those transfers are not subject to taxation. Crypto accounting software automates the accounting for organizations and individuals that trade cryptocurrency, use cryptocurrency to make payments, or accept cryptocurrency for their receivables.

- By monitoring the exchange rates, you can make informed decisions regarding buying or selling bitcoin.

- In the second quarter of 2021, Microstrategy added nearly $500 million of additional Bitcoin holdings.

- With the help of blockchain technology, bitcoin transactions can be recorded transparently and securely.

- It’s significantly faster and less costly than wire transfers, while saving accountants hours every week by streamlining all the necessary invoices and reports.

- Utilize the blockchain, your Bitcoin wallet transaction history, and cryptocurrency exchange records to keep an accurate record of your cryptocurrency finances.

- Usually, the entry-level salary for both bookkeepers and accountants tends to be similar; however, the earning potential of an accountant tends to increase as their career progress.

- With the rising popularity and value of Bitcoin, proper accounting and bookkeeping practices are crucial to ensure accurate financial records.

This uncertainty causes a good deal of trouble for businesses and accountants. At this point, businesses that operate with cryptocurrencies need to work closely with accounting professionals who are well-versed in this area. Staying updated on regulatory changes is equally vital to ensure compliance with tax laws and financial reporting requirements.

Cross-Border Tax Newsletter Signup

These resources can provide you with the expertise and tools necessary to effectively manage your Bitcoin finances and ensure accurate and efficient bookkeeping. Managing your Bitcoin finances for tax purposes is an essential part of responsible bookkeeping. As the popularity of cryptocurrency grows, governments around the world are taking notice and enacting regulations to ensure proper reporting and taxation. To avoid any legal issues and accurately report your Bitcoin transactions, it’s crucial to maintain meticulous records. One important aspect of reporting your Bitcoin holdings is keeping track of your transactions on various exchanges. If you frequently trade on different platforms, it’s crucial to maintain a record of your buys, sells, and transfers.

By keeping detailed records, you can easily report your gains, losses, and any necessary tax obligations. It also provides transparency to tax authorities, which can improve your credibility and help maintain a good relationship with them. The digital nature of cryptocurrencies exposes them to hacking and cyberattacks, leading to the potential bitcoin bookkeeper loss of valuable assets. Security is a big concern in cryptocurrency accounting, requiring solid measures to safeguard digital holdings. This introduces an additional layer of complexity, as accountants and financial professionals must ensure the secure storage and management of cryptocurrency assets while maintaining accurate records.

Keeping track of exchanges

Imagine a giant, unchangeable, and transparent book that records every transaction ever made with a cryptocurrency. But instead of being stored in one place, this digital book is duplicated and distributed across many computers worldwide. Although the middle man slows down transactions and adds fees for their services, they’re not all bad. The middle man plays a large role in protecting both parties in the exchange of assets from fraud. This is done securely using a consensus protocol, or a set of rules based on mutual agreement. A Bitcoin wallet is a digital wallet that allows you to securely store, send, and receive Bitcoin.

- In this section, we will look at some of the key benefits that come with effective bookkeeping and accounting practices for your digital assets.

- There are different types of bookkeeping services available, depending on the time and money investment you want to make.

- Fortris handles digital asset treasury operations for enterprise business.

- By meticulously recording your transactions, you can accurately calculate your Bitcoin holdings at any given time.

- Please note that these tips are not limited to Bitcoin only; they can also apply to other cryptocurrencies.

- Blockchain has gained a lot of traction despite being a polarizing technology and an elusive concept for many.

- This will help you make informed decisions about what digital assets to accept, and when to buy or sell.

Cryptocurrency exchanges, such as Coinbase, provide real-time pricing information. You can also use financial news websites, dedicated cryptocurrency tracking apps, or online calculators. When it comes to Bitcoin accounting, one of the most important aspects is keeping your records secure.